“I think my securities far outweigh my insecurities. I am not nearly as afraid of myself and my imagination as I used to be.” – Billy Connolly

I woke up this morning to an incredible spectacle on Twitter. Just when I thought I’d seen it all – and trust me, I’ve seen a lot – I discover that Coinbase claimed it had received a Wells Notice from the Securities and Exchange Commission (SEC) over the company’s desire to launch a crypto lending program called Lend. The company attempted to preempt the SEC by publishing an incredibly silly blog about it, and the company’s CEO took to Twitter to write a bizarre thread that he’ll surely come to regret.

Lots to unpack here, so let’s back up a little and begin with what a Wells Notice is and why it matters. Here’s how Wikipedia defines it (emphasis added):

“A Wells notice is a letter that the U.S. Securities and Exchange Commission (SEC) sends to people or firms when it is planning to bring an enforcement action against them. It is issued at the conclusion of an SEC Investigation notifying the people or firm in question that the SEC has concluded that they should be charged with violation of the securities laws.”

To an executive, receiving a Wells Notice from the SEC is just about the worst thing that can happen to you. Except for the few years when the SEC was led by the feckless Jay Clayton, a Wells Notice often had a strong and uncomfortable association with words like “Department of Justice,” “criminal charges,” “felony,” and “prison time.” Not all Wells Notices led to such outcomes, but many did. Disclosure that a Wells Notice had been received – either by the company, its key executives, or both – usually sent the stock tanking, sometimes irreversibly.

At reasonable companies, the intelligent response to receiving a Wells Notice used to involve a combination of treating the event with the seriousness that it deserved, politely begging the SEC for a reasonable settlement, and proactively fixing the problem that provoked the SEC’s ire in the first place. Board members – themselves worried about their own personal liability as guardians of shareholder value – often fired key members of the management team, hoping to isolate the event to “a few bad actors,” thereby ringfencing the problem and protecting shareholder value.

It appears that Coinbase is doing none of these things.

Let’s begin with the jaw-dropping blog post published by the company early this morning, authored by the Coinbase’s Chief Legal Officer, Paul Grewal. The entire thing is crazy, but here’s my favorite part (once again, emphasis added):

“Despite Coinbase keeping Lend off the market and providing detailed information, the SEC still won’t explain why they see a problem. Rather they have now told us that if we launch Lend they intend to sue. Yet again, we asked if the SEC would share their reasoning with us, and yet again they refused. They have only told us that they are assessing our Lend product through the prism of decades-old Supreme Court cases called Howey and Reves. The SEC won’t share the assessment itself, only the fact that they have done it. These two cases are from 1946 and 1990. Formal guidance from the SEC about how they intend to apply Howey and Reves tests to products like Lend would be a big help to regulating our industry in a responsible way. Instead, last week’s Wells notice tells us that the SEC would rather skip those basic regulatory steps and go right to litigation. They’ve offered us the chance to submit a written defense of Lend, but that would be futile when we don’t know the reasons behind the SEC’s concerns.”

The arrogance is something to behold. Imagine what Gary Gensler, chair of the SEC, thought as he read that passage? Do you think he likes being called irresponsible by a target of a Wells Notice? Did Coinbase not think about the consequences of becoming a public company before their direct listing? To everybody not named Elon Musk, the SEC calls the shots – and Elon Musk already exists.

But it gets better.

Not satisfied with the puffery of that blog post, the co-founder and CEO of Coinbase – a chap named Brian Armstrong – took to Twitter and stepped up the stupidity a few more notches. Here’s the opening salvo of his 21-part thread:

Not satisfied with calling Gensler irresponsible and basic, Armstrong leads with calling the SEC’s behavior “sketchy.” We turn to Merriam-Webster for the definition of sketchy as undoubtedly used in this context:

“The adjective has more recently extended in use to describe someone who creates an impression of unsavoriness, or something that comes from an untrustworthy source or is itself untrustworthy, as in ‘a sketchy dude’ or ‘a scheme that sounds sketchy.’”

A sketchy dude is so great. An indignant crypto bro calling the SEC chair a sketchy dude is the perfect moment for our time.

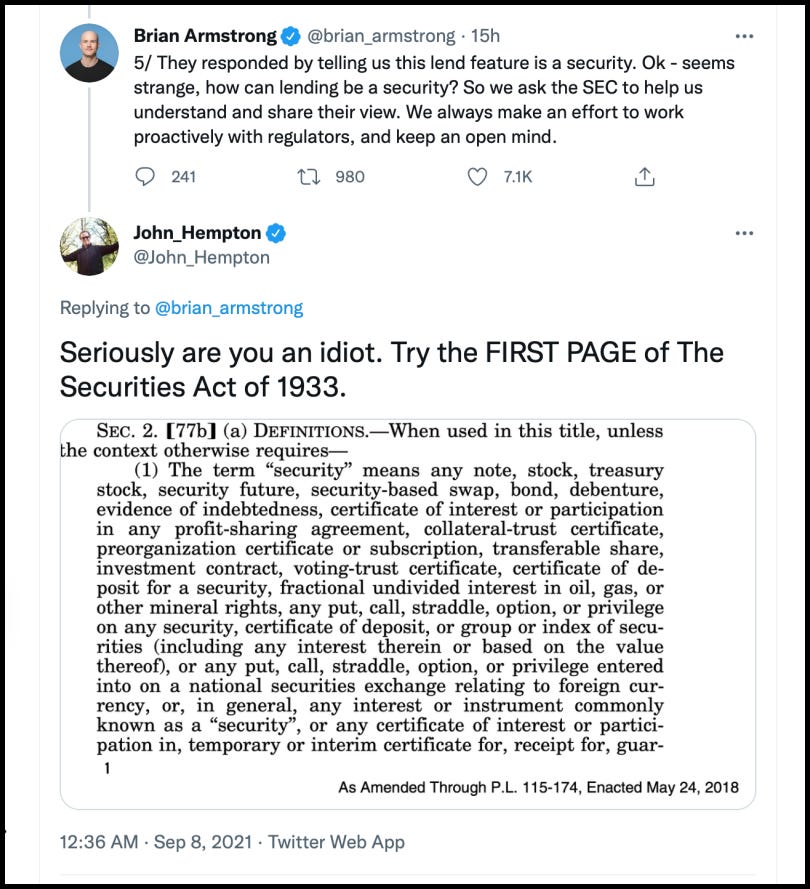

In another perfect moment – the kind that only Twitter can deliver – Armstrong bizarrely claims to be puzzled that the SEC deems lending to be a security, only to be “corrected” by famous hedge fund manager John Hempton:

Here’s what I think might be going on here. The SEC is likely pretty upset with Coinbase for its misrepresentation to investors that the stablecoin USDC was fully backed by US dollars sitting in a bank, even after Circle admitted it wasn’t. Coinbase kept this proclamation on its website for weeks after Circle came clean. Simply put, this isn’t something public companies should be doing, and it likely gave Gensler the opening he needed to make an example out of Coinbase. It is important to note that Coinbase is a partner to Circle and helped bring USDC to market. Here’s how they announced it in 2018:

“The first major initiative from CENTRE is USD Coin, a stablecoin technology and network scheme. Circle became the first issuer of USDC just weeks ago and with this announcement, Coinbase is making it available to customers on Coinbase Pro and Coinbase.com. Customers can tokenize dollars into USDC and redeem USDC into dollars through both Circle and Coinbase, making USD Coin the industry’s first open, fungible and interoperable fiat stablecoin.”

My read of the situation is that the SEC intends to sue Coinbase regardless of whether they launch their Lend program or not – you don’t get a Wells Notice for something you are considering doing, you get one for deeds you’ve already done.

Finally, as we’ve covered before, Circle is trying to go public via a merger with Concord Acquisition Corporation, a special purpose acquisition company. If my interpretation of this morning’s fiasco is correct, I imagine getting that deal closed just became a lot more difficult. Given what I suspect is going to befall Coinbase, perhaps Circle will be smart enough to drop that effort and stay private.

Be mindful of the sketchy dude, bro. He seems to be playing for keeps.

If you enjoy Doomberg, subscribe and share a link with your most paranoid friend!

I don't know anymore. I think I'll just stash my money under my mattress. I can't trust stablecoins if we get stuff like this every other week.

Is Lend (the crypto lending program) similar to Gemini has with Gemini Earn?